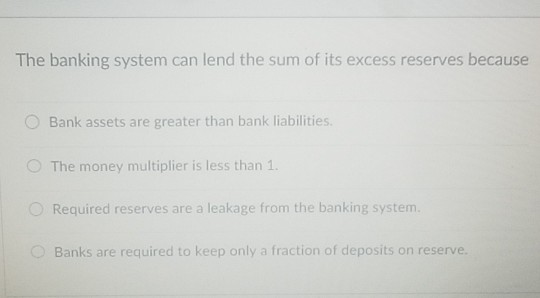

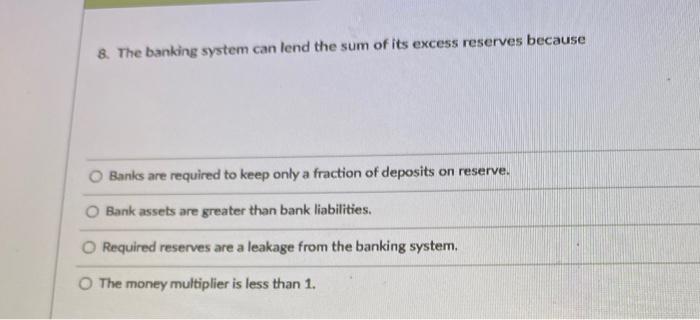

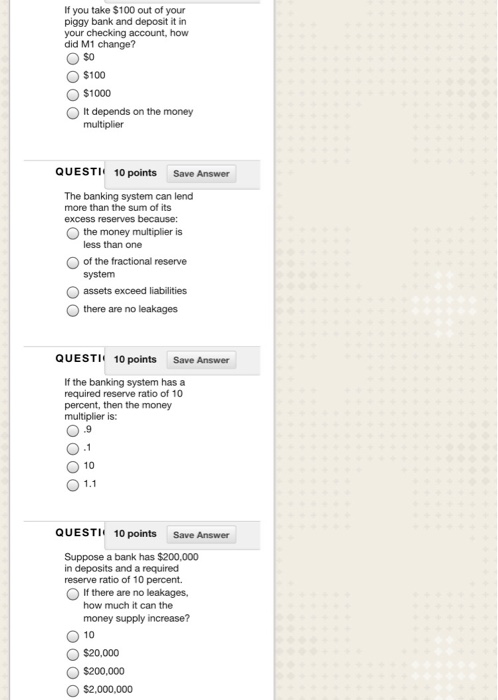

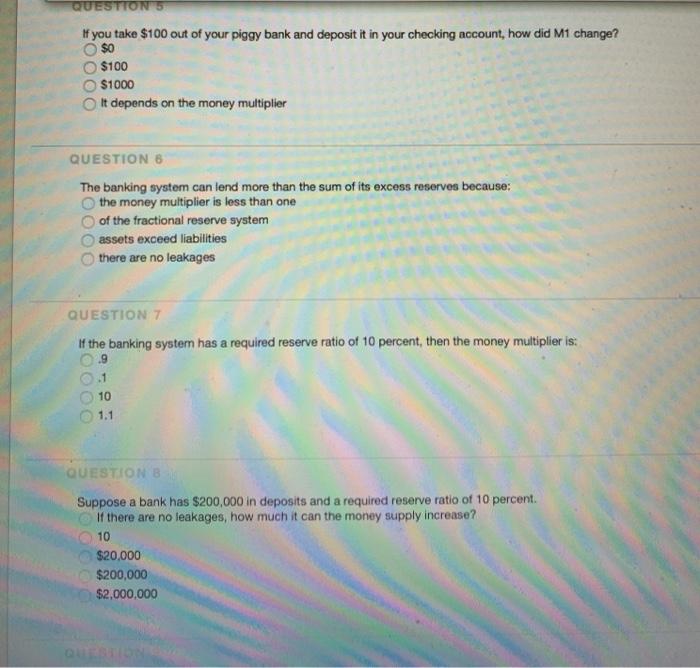

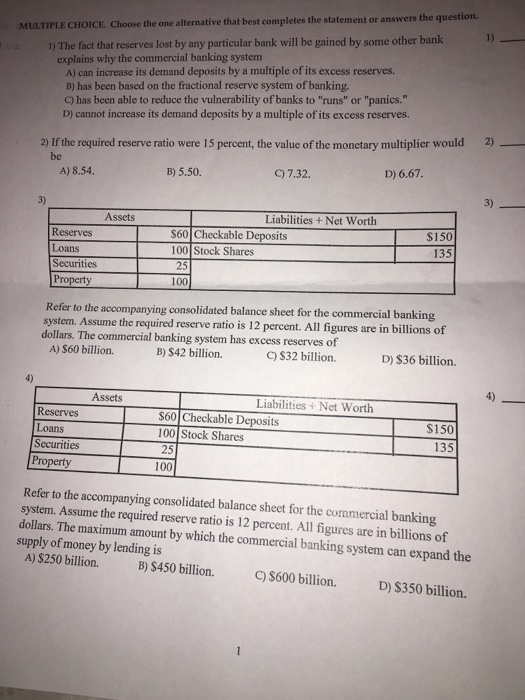

The Banking System Can Lend The Sum Of Its Excess Reserves Because

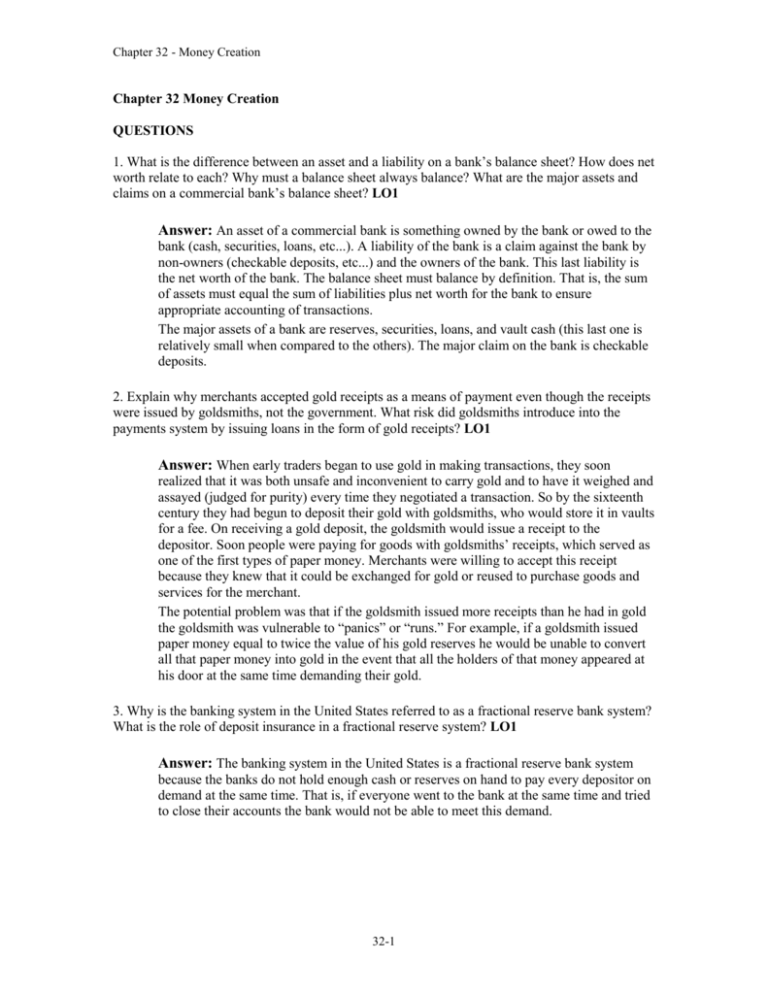

The banking system can lend the sum of its excess reserves because. The sum of balances in the clearing accounts and reserve accounts kept with the central bank. Money And Banking Important Questions. Because banks play an important role in financial stability and the economy of a country most jurisdictions exercise a high degree of regulation over banks.

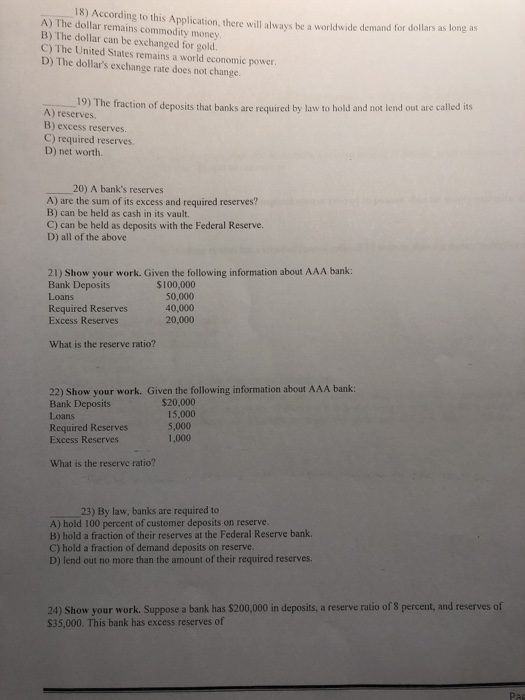

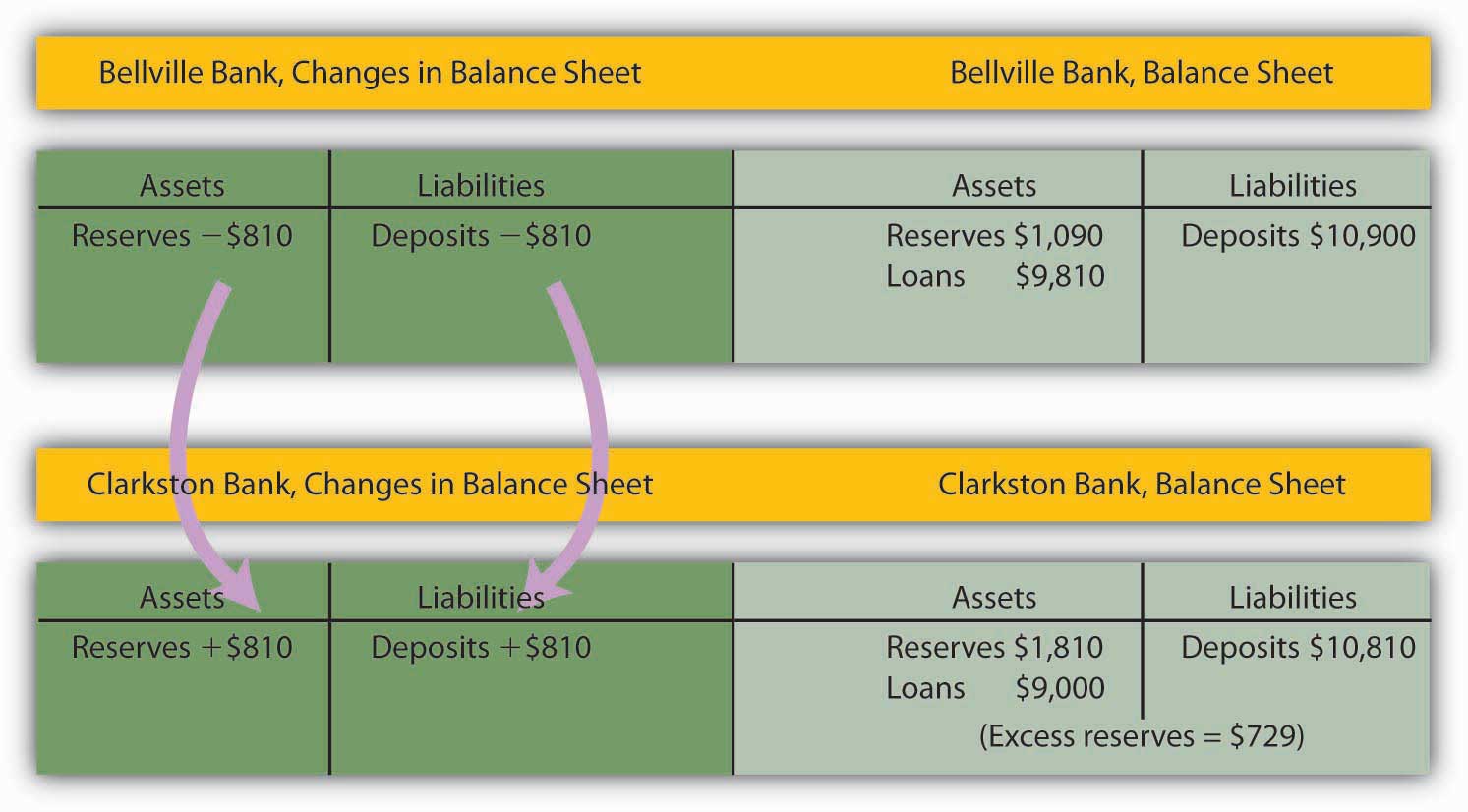

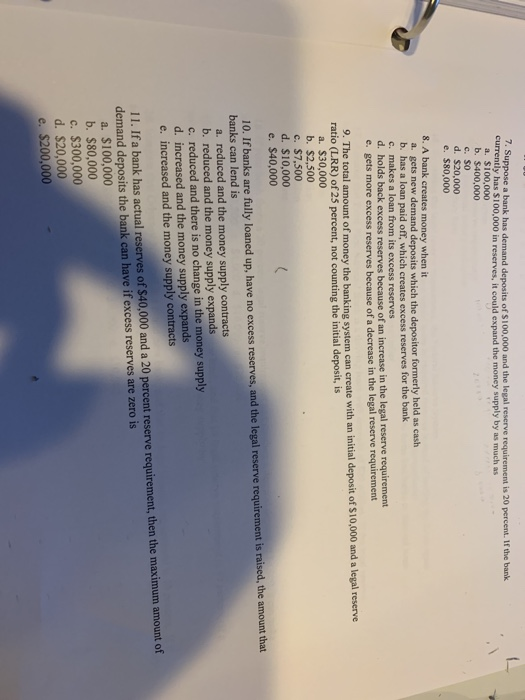

Just as Acme lent the amount of its excess reserves we can expect Bellville to lend this 810. 10 percent of its capital and surplus. Thus this concept tells us that the monetary authorities can control the money supply through changing the high-powered money or.

The Liquidity Coverage Ratio and Corporate Liquidity Management. Because saving can cross international borders a countrys domestic investment in new capital and its domestic saving need not be equal in each period. Banks tend not to hold a lot of excess reserves because.

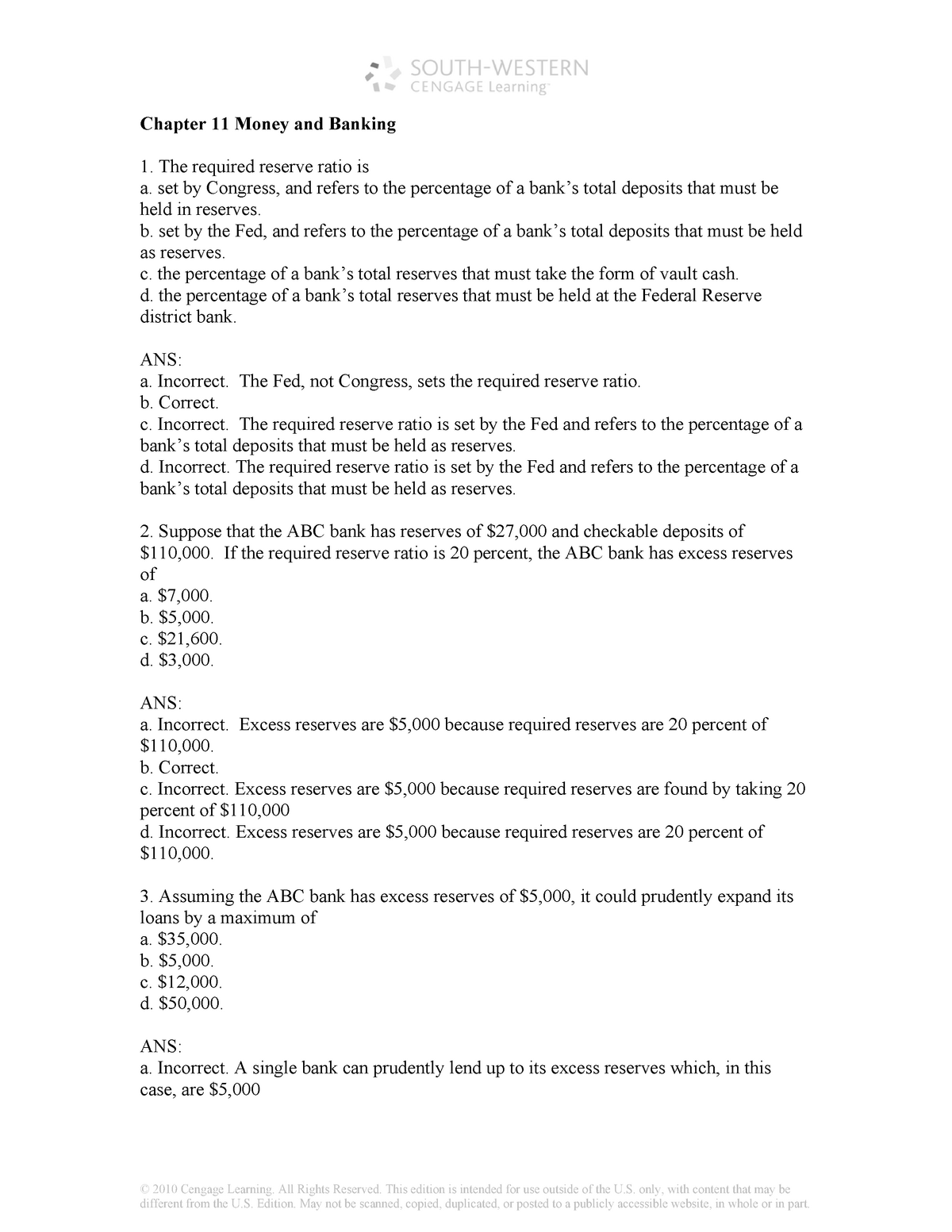

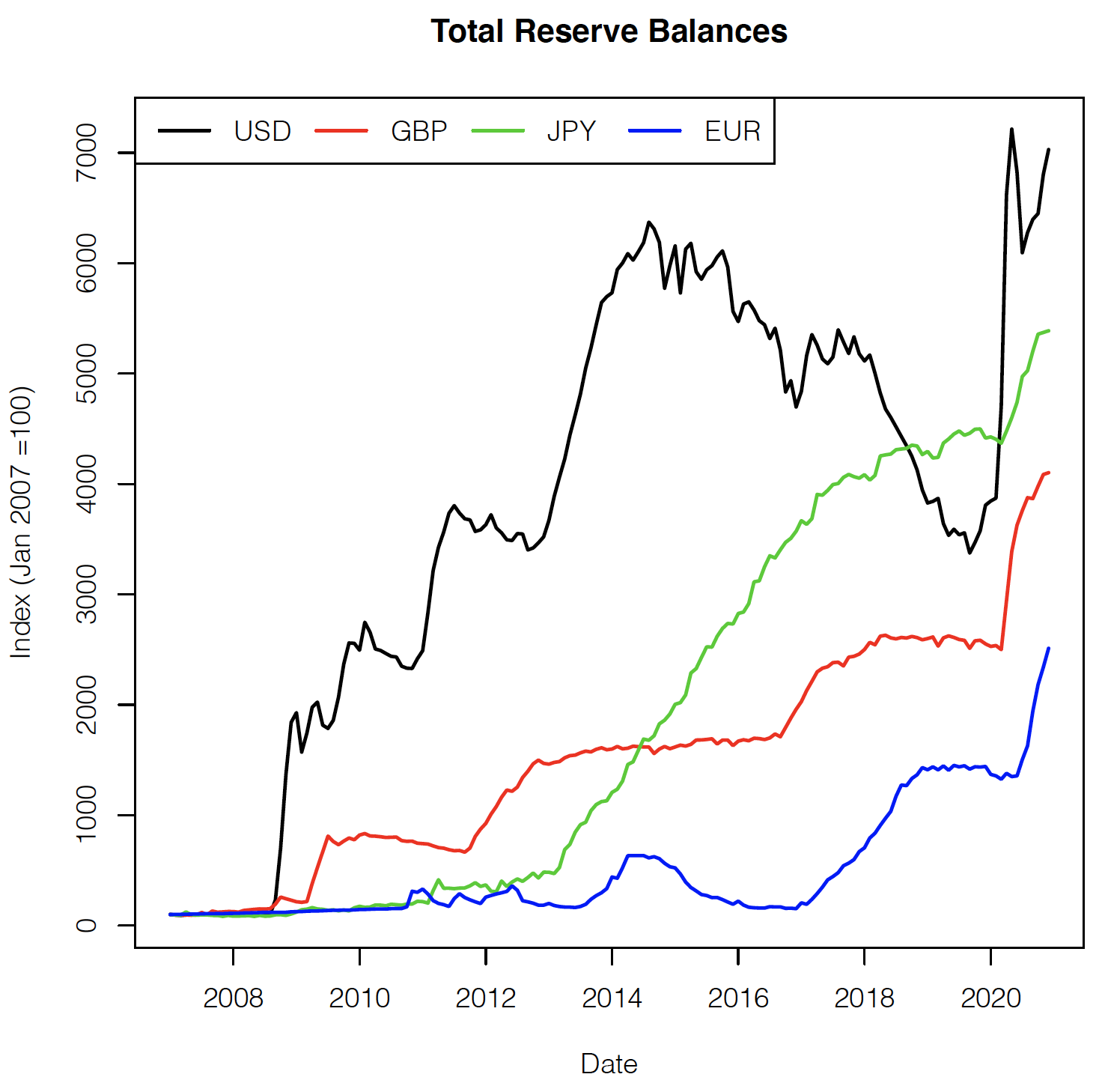

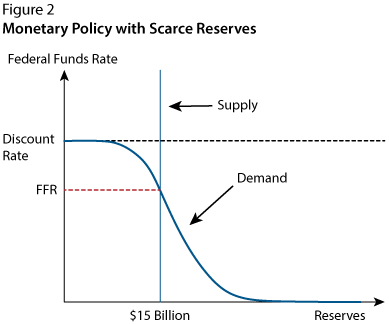

Fractional-reserve banking is the system of banking operating in almost all countries worldwide under which banks that take deposits from the public are required to hold a proportion of their deposit liabilities in liquid assets as a reserve and are at liberty to lend the remainder to borrowers. If the Fed wants to increase the money supply it can decrease the interest rate it pays on reserves. These investments are characterized by a high degree of safety and relatively low rates of return.

In the merger each share of Business Bank common stock except for specified shares of Business Bank common stock held by Business Bank Florida Business Bank Seacoast or SNB and any dissenting shares will be converted into the right to receive 07997 the exchange ratio of a share of Seacoast common stock subject to the payment of cash in lieu of fractional shares the merger. Two ways to confirm. February 26 2020.

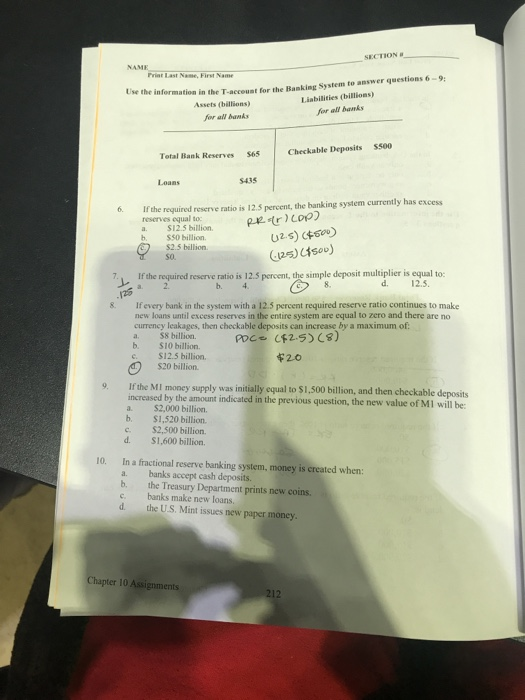

Reserves banks have and the more money banking system can create. So the useful life depends on the entity and therefore its not really possible to set some benchmark. Regulators penalize banks that have too much in excess reserves B.

And if households choose to hold more in cash and less in deposits banks lose reserves and money supply decreases. As the charter of the organization the Articles lay out the Funds purposes which.

10 percent of its capital and surplus.

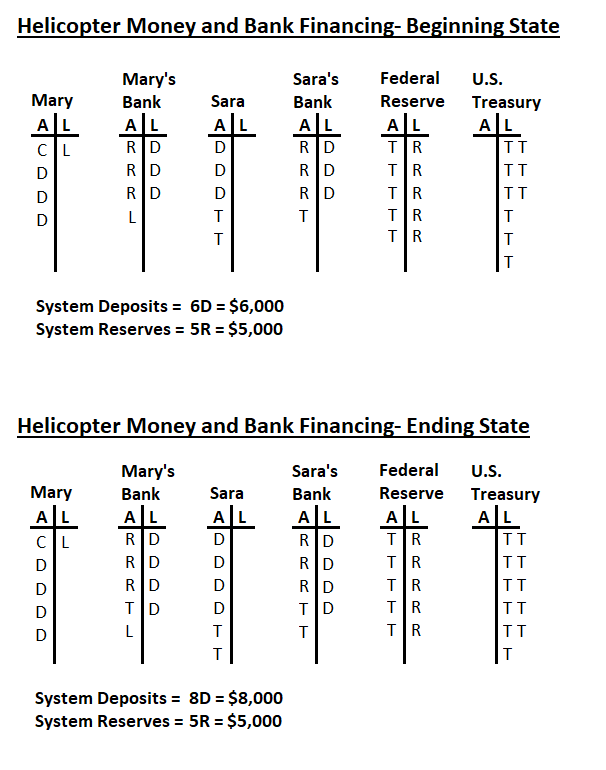

If the Fed wants to increase the money supply it can decrease the interest rate it pays on reserves. Just as Acme lent the amount of its excess reserves we can expect Bellville to lend this 810. A bank is a financial institution that accepts deposits from the public and creates a demand deposit while simultaneously making loans. However the facility can be availed for Joint Accounts with mode of Operation as EitherSurvivor or FormerSurvivor provided a mandate to that effect is submitted to the Bank. The sum of balances in the clearing accounts and reserve accounts kept with the central bank. If banks decide to hold more excess reserves and make fewer loans. An increase in money supply that results from it comes from the banking system which creates new money on the basis of its newly acquired excess reserves. In Hong Kong this refers to the sum of the balances in the clearing accounts kept with the HKMAThe Aggregate Balance is a part of the Monetary BaseSince June 1998 the HKMA has been disclosing forecast changes in the Aggregate Balance attributable to the HKMAs foreign exchange. This can be done quite a bit if banks start with excess reserves because every time the federal government injects more money into the system it creates more bank deposits which replenishes the reserves that the bank spent buying Treasuries and thus gives the banks more ability to.

As the charter of the organization the Articles lay out the Funds purposes which. And if households choose to hold more in cash and less in deposits banks lose reserves and money supply decreases. An increase in money supply that results from it comes from the banking system which creates new money on the basis of its newly acquired excess reserves. Holding excess reserves will increase a banks leverage D. Banks tend not to hold a lot of excess reserves because. Just as Acme lent the amount of its excess reserves we can expect Bellville to lend this 810. Or the percent of its.

/dotdash_final_Deposit_Multiplier_Dec_2020-01-12355ee057a74ef1887bb1066444b606.jpg)

Post a Comment for "The Banking System Can Lend The Sum Of Its Excess Reserves Because"